Catastrophe Adjuster: Specialist Assist for Major Insurance Claims

Catastrophe Adjuster: Specialist Assist for Major Insurance Claims

Blog Article

Exactly How a Disaster Adjuster Can Optimize Your Insurance Policy Insurance Claim

Browsing the complexities of an insurance claim following a calamity can be overwhelming, specifically when trying to guarantee a fair settlement. A catastrophe adjuster has the expertise to streamline this procedure, providing useful insights that can substantially improve your case's result.

Recognizing Catastrophe Insurers

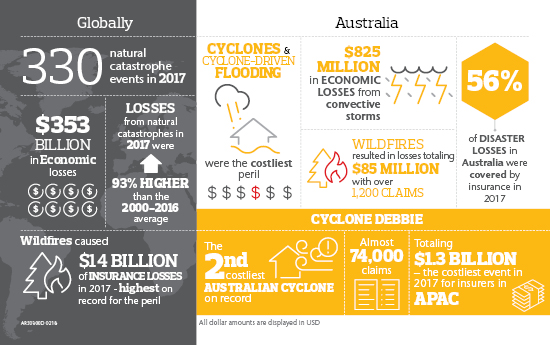

Catastrophe insurance adjusters play an essential duty in the insurance policy declares process, especially in the aftermath of substantial disasters. These experts concentrate on evaluating problems resulting from disastrous occasions such as typhoons, fires, floodings, and earthquakes. Their knowledge is important for properly evaluating the degree of losses and establishing proper settlement for insurance holders.

A disaster insurance adjuster typically possesses customized training and experience in disaster-related claims, enabling them to navigate the complexities of insurance coverage and regional laws. They perform comprehensive inspections of damaged buildings, assemble thorough records, and gather supporting paperwork to corroborate insurance claims. This process usually entails functioning very closely with insurance holders, contractors, and other stakeholders to guarantee an extensive evaluation is completed.

In addition to assessing physical damages, catastrophe adjusters additionally consider the financial and psychological effect on damaged people, using support throughout the insurance claims process. Their objective perspective aids keep fairness and transparency, ensuring that policyholders obtain the advantages they are entitled to under their insurance plans - catastrophe claims. Comprehending the function of catastrophe insurance adjusters is essential for insurance holders seeking to maximize their insurance claims, as their knowledge can dramatically influence the end result of the insurance claims process

Advantages of Working With a Catastrophe Adjuster

Employing a disaster adjuster can offer considerable advantages for policyholders browsing the insurance claims procedure after a catastrophe. These specialists focus on evaluating damages from catastrophic events, ensuring that the assessment is exact and thorough. Their know-how allows for a thorough understanding of the complexities associated with insurance coverage cases, which can often be frustrating for policyholders.

One of the main advantages of hiring a catastrophe insurer is their ability to maximize claim settlements. Their understanding of sector requirements and techniques allows them to support effectively on part of the insurance holder, ensuring that all eligible damages are recorded and valued properly. This campaigning for can result in greater economic recuperation than what an insurance policy holder could attain by themselves.

Additionally, disaster adjusters bring objectivity to the claims procedure. They are not emotionally spent in the consequences of the calamity, permitting them to examine problems without predisposition. In addition, their experience in negotiating with insurance policy companies can accelerate the cases process, decreasing delays that usually occur when insurance policy holders manage insurance claims individually.

Ultimately, engaging a disaster insurer can reduce the problem of browsing a complicated insurance landscape, supplying comfort throughout a tough time.

The Claims Refine Described

After your case is filed, an insurance policy adjuster, commonly a disaster insurer in serious cases, will certainly be designated to examine the damage. This expert will certainly evaluate the level of the loss, evaluate your check plan for coverage, and figure out the appropriate settlement. It is crucial to document the damage extensively, consisting of pictures and an in-depth supply of lost or damaged products.

The insurance company will certainly then evaluate the claim and communicate their choice pertaining to the payout. Throughout this process, maintaining clear interaction with your insurer and recognizing your policy will considerably improve your capability to browse the cases process effectively.

Usual Blunders to Stay Clear Of

Navigating the insurance policy declares procedure can be tough, and my review here preventing usual risks is important for optimizing your payout. Without proper evidence, such as pictures and comprehensive summaries, it ends up being challenging to confirm your claim.

Another common mistake is ignoring the timeline for filing an insurance claim. Several plans have strict due dates, and hold-ups can result in rejection.

In addition, neglecting plan information can impede your claim. Acquainting yourself with insurance coverage limitations, exclusions, and specific requirements is crucial. Last but not least, falling short to look for specialist aid can considerably affect the result. A catastrophe adjuster can offer invaluable support, guaranteeing that you avoid these pitfalls and browse the cases procedure effectively. By identifying and staying clear of these typical mistakes, you can considerably improve your chances of receiving a sufficient and reasonable negotiation.

Choosing the Right Insurance Adjuster

When it concerns optimizing your insurance policy case, choosing the best insurer is an important action in the process. The adjuster you pick can considerably influence the result of your case, affecting both the rate of resolution and the quantity you get.

Next, consider their reputation. Seek reviews or endorsements from previous clients to evaluate their reliability and effectiveness. An excellent insurer needs to connect plainly and supply routine updates on the progression of your case.

Verdict

In verdict, engaging a catastrophe adjuster can substantially boost the capacity for a beneficial insurance claim end result. Their experience in browsing complicated policies, conducting complete examinations, and efficiently negotiating with insurance policy firms guarantees that policyholders receive reasonable payment for their losses. By avoiding usual pitfalls and leveraging the insurer's specialized understanding, individuals can optimize their claims and relieve the concerns related to the insurance claims process, inevitably resulting in an extra adequate resolution in the after-effects of a disaster.

Catastrophe insurance adjusters play an essential function in the insurance policy asserts process, especially in the consequences of substantial catastrophes. Understanding the role of disaster adjusters is necessary for policyholders seeking to optimize their claims, as their experience can substantially affect the outcome of the insurance claims process.

Their experience in bargaining with insurance business can accelerate the cases process, decreasing delays that commonly take place when insurance policy holders manage cases separately.

After your claim is filed, an insurance adjuster, commonly a disaster insurer in severe cases, will be assigned to evaluate the damage. By avoiding common mistakes and leveraging the insurance adjuster's specialized understanding, people can maximize their cases and minimize the concerns connected with the insurance claims process, eventually leading to an extra acceptable resolution in the consequences of a catastrophe.

Report this page